Japan to subsidize up to HALF THE COST of mine development and smelting projects for lithium and other minerals

05/08/2023 / By Kevin Hughes

Japan’s Ministry of Economy, Trade and Industry (METI) will bankroll up to half the cost of mine development and smelting projects for lithium and other important minerals by Japanese companies.

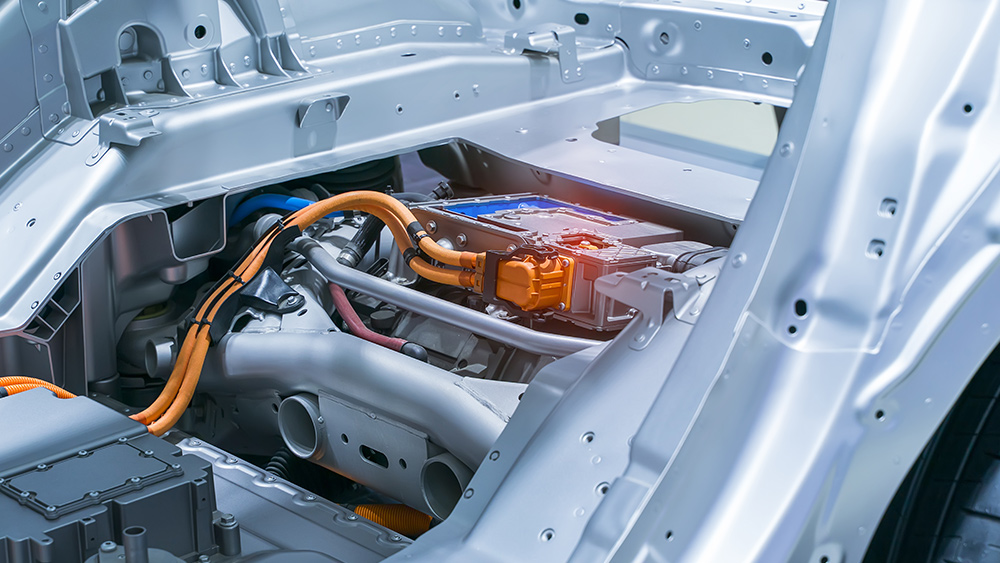

According to an April 23 report by Nikkei Asia, METI is targeting several elements – namely lithium, manganese, nickel, cobalt, graphite and rare earth metals. The ministry’s initiative seeks to obtain essential raw materials used in the production of electric vehicles (EVs). The raw materials targeted by METI are used for lithium-ion batteries and permanent magnets used in high-performance engines.

Through the initiative, Japan plans to diversify its supply network as it currently depends on countries like China for several important minerals. Support will be given through the Japan Organization for Metals and Energy Security, which will be drawing from ¥105.8 billion ($788 million) already allotted for related expenses.

Projects to be funded under the METI scheme include geological surveys that will determine the profitability and quality of mines, mine development and smelting operations. The development of technologies that enhance productivity and decrease costs in the smelting process are also encompassed.

Companies receiving the subsidies will be required to keep operations for at least five years from the beginning of mining and the smelting process. A provision will also require a certain amount of the output to be supplied to Japan. In the event of a supply crisis, participating corporations will be called on to make every effort to give the total amount. (Related: Lithium supply not large enough to not meet ambitious global EV deadlines, mining CEO warns.)

Japan does not want to depend on China for EV battery materials

Consulting firm McKinsey & Co. noted that worldwide demand for lithium-ion batteries for EVs and plug-in hybrid cars will increase to 4,700 gigawatt-hours (GWh) in 2030 – almost seven times the 2022 level. Given this, the demand for critical minerals used in EV batteries, electronics and solar panels is expected to soar.

Industry stakeholders are worried about the growing reliance on a few nations for strategic raw materials. For example, China supplies between 60 to 70 percent of lithium and cobalt processing for battery cathode materials per the International Energy Agency. China also supplies 70 percent of graphite for battery anode materials, and is also responsible for nearly all the rare-earth mineral processing in the world.

Back in 2010, China temporarily stopped exports of rare-earth materials to Japan. The export ban stemmed from a territorial conflict over the Senkaku Islands – which are claimed by Japan, China and Taiwan. The resulting supply shortage interrupted the Japanese manufacturing industry and caused prices to soar.

Determined not to repeat this mistake, the Japanese government is aiming for a seven-fold hike in domestic battery production. It aims for an annual 150 GWh in 2030, nearly seven times the current capacity. Securing those raw materials is critical to achieving that goal for Tokyo.

Follow GreenDeal.news for more news about lithium and rare-earth metals used for electric vehicles.

Watch this G News report about why Africa is critical to China’s EV race with Western nations.

This video is from the Chinese taking down EVIL CCP channel on Brighteon.com.

More related stories:

US, Japan sign trade agreement on minerals for electric vehicle batteries. “Green” energy components are almost all made in China, and many use minerals from dirty mining operations.

South American countries planning to create LITHIUM CARTEL.

Lithium batteries used in EVs and other “green” technology are anything but clean.

Sources include:

Submit a correction >>

Tagged Under:

big government, China, electric cars, electric vehicles, EV batteries, EV engines, government funding, government support, Japan, lithium, manufacturing, mining, rare earth metals, renewable energy, supply chain

This article may contain statements that reflect the opinion of the author